Parents & Kids

Together

Stockpile empowers families to invest in their future and learn by doing.

Scan to Download Stockpile

Join Over 1 Million

Parents & Kids

Stockpile is a best-in-class 4.7★ investment app.

Best App for

Custodial Accounts

Custodial Accounts

Best Investment

App for Beginners

App for Beginners

Best Investment

App for Parents

App for Parents

Best App for

Gifting Stocks

Gifting Stocks

Empowering Kids To Invest In Their Future

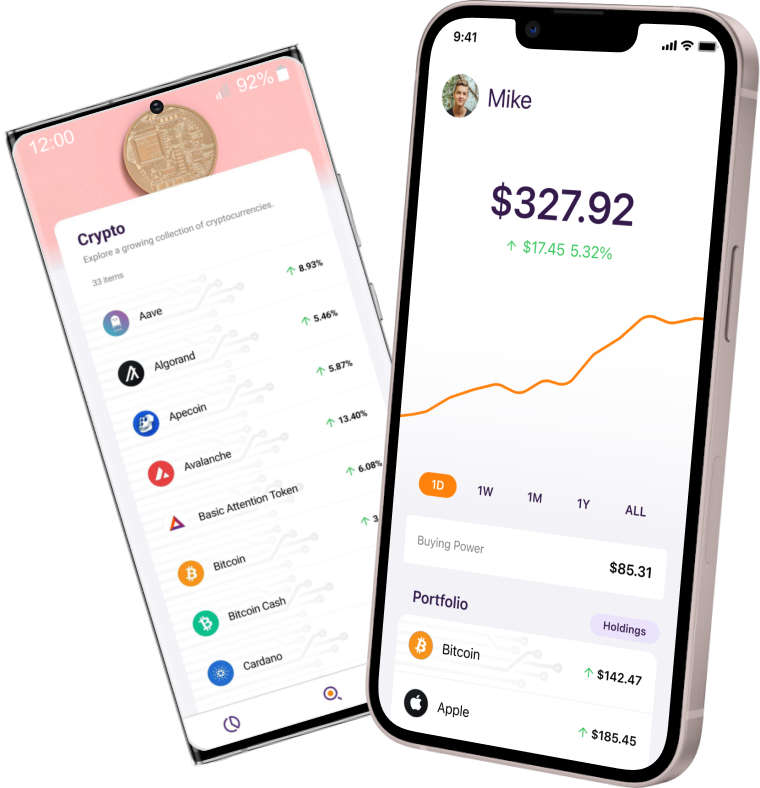

Designed for families

An easy-to-use app for parents to invest with their kids, not just for them.

Hands-on learning

Kids learn by doing - making their own trades that adults approve.

Access to Crypto

You can buy, sell, and hold crypto in our app. Execution and custody provided by Bakkt.

Fractional trading

With as little as $1, own stocks or cryptos you and your children love.

Debit card checkout

Buy stocks immediately without the need to link a bank account.

Build Financial Confidence

With Hands-On Learning

Build confidence in investing.

Build confidence for life.

We Make It

Easy For Families

To Invest

As featured on

Customer testimonials may not be representative of the experience of other customers, and their testimonials are no guarantee of future performance or success.

One Affordable Plan That Covers the Entire Family

Free for 30 days

Stockpile Membership

$4.95/month. Cancel anytime.

1 adult account

5 kids accounts

Hands-on learning feature

4000+ stocks and ETFs

Access to crypto*

Fractional trading

Debit card checkout

Start Your Free Trial Today

Start Your Free Trial Today

A Child’s Future

Is a Special Gift

Family and friends can help contribute to your child’s financial future. Stockpile offers gift cards for investing in stocks or crypto.

Gift cards are offered by Stockpile Gifts, Inc.

Frequently Asked Questions

{{currentBasketId}}