PRINCIPLE 01

The earlier

you get in,

the better

Company stock prices rise and fall and investing usually comes with some amount of risk.

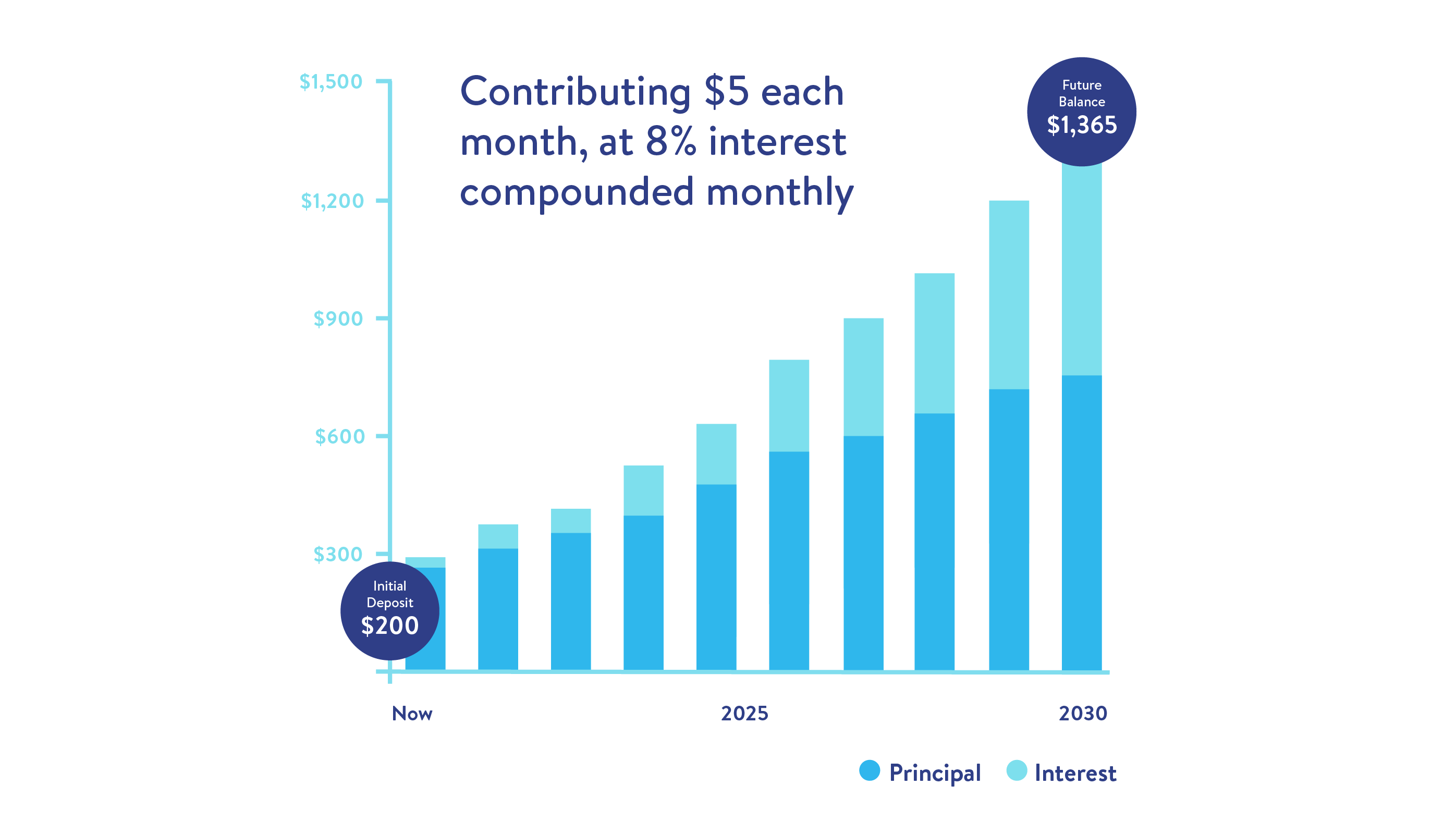

But if you get in early and stay there, your money could grow substantially over time. Compounding is really what accelerates that growth.* For example, if you start with $200 and add just $5 each month, and you earn 8% compounded monthly, you could have $1365 after 10 years. You are contributing slowly but you’re earning interest on the money you keep adding. In other words, your gains are earning gains.

How Compound Returns Work

A hypothetical scenario for illustration purposes only.

This is an excellent reason to open a custodial account for the young person in your life (child, grandchild, niece, friend’s kid). Not only could it give them a nice jumpstart in life, but it’ll give you both something to bond over as they start to learn the ins and outs of the stock market. Stockpile makes it easy to get them started.

* While the market has historically grown by an average of 10% per year, purchasing power does tend to decrease every year. Between 2010 and 2019, it decreased by 1.77% annually.